Automate Liquiditythe easy way

Optimize and automate your liquidity with just a few clicks. Metavisor automatically optimizes your liquidity positions to maximize returns, while saving on gas fees.

Available truly everywhere.

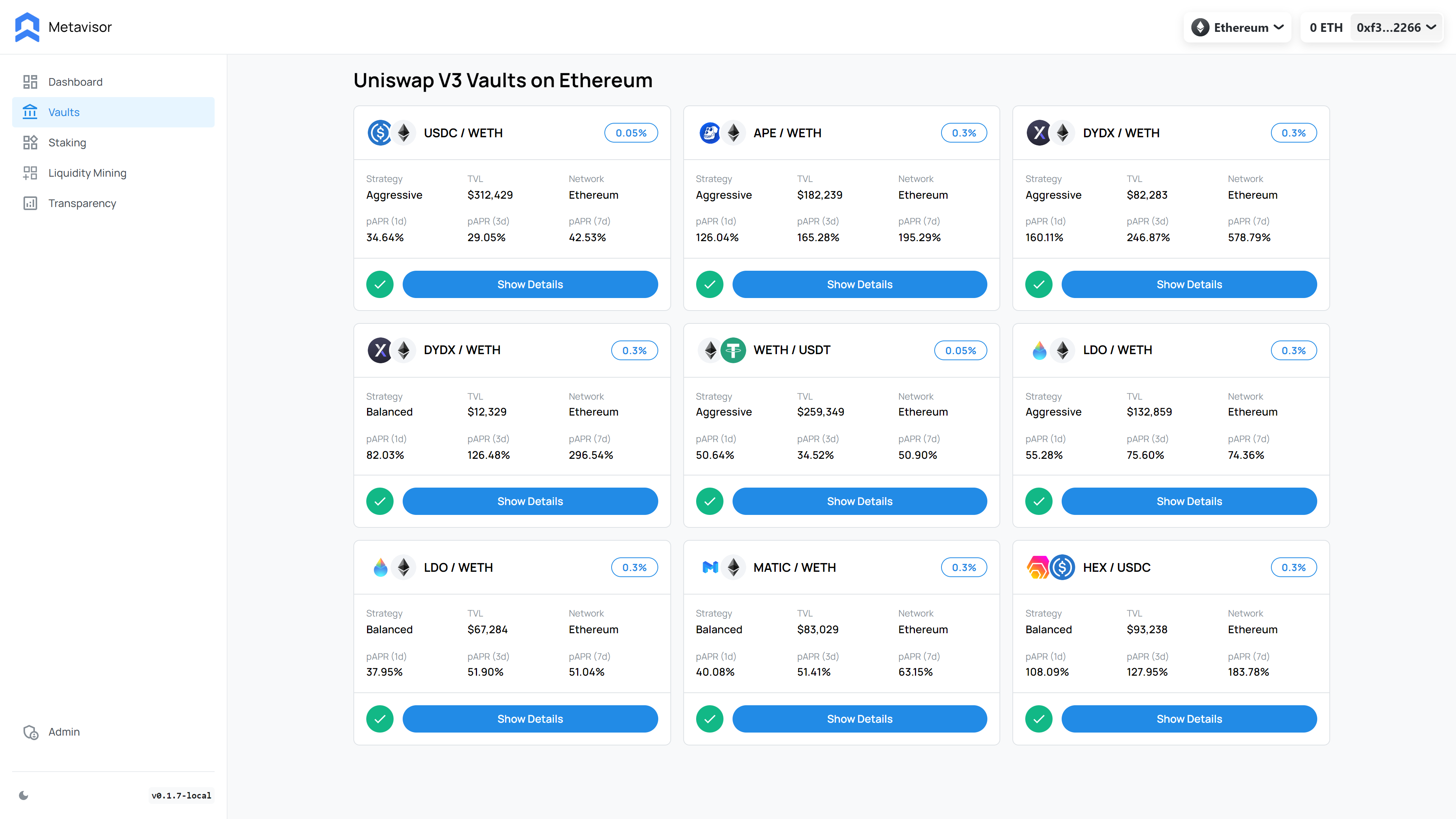

Uniswap V3

Maximum Returns, Minimum Headaches

Uniswap V3 Optimizer automatically manages your positions and ensures that your liquidity is always in the most optimal range to ensure maximum returns.

- Permissionless.

- You, and only you, can ever touch your deposited assets.

- Automated.

- Someone once said, humans are the weakest link. We agree.

- Secure.

- Audited by the industry leaders, continuously tested for efficiency.

- Optimal.

- Strategy is optimized to maximize returns while minimizing risk.

- Proven.

- Tested on major pools, with an average of >30% improvement in returns.

- Trusted.

- Our vaults are used by a variety of liquidity providers in the industry.

Security

You, and only you, are in control.

Metavisor is fully audited, has been tested rigorously, and continuously monitored to ensure that your funds are always safe.

Audited by Omniscia

Security

The vaults are designed with security as the priority.

Permissionless

With no outside control, your funds are always safe.

Audited

The protocol is formally audited to ensure it is safe.

Monitored

The vaults are continuously monitored for any anomalies.

FAQs

You have questions, we have answers.

We're here to answer any question you may have, and here is a curated list of most commonly asked questions. Feel free to ask more!

What is concentrated liquidity?

Uniswap V3 introduced the concept of concentrated liquidity allowing you to deposit funds in a small range instead of depositing for the full range. This allows you to earn more fees but also exposes you to more risk. This significantly improves capital efficiency and yield but also requires more work to decide and work with optimal ranges.

Why does Metavisor exist?

We realized how hard it is to manage liquidity and decided to make it easier. Over time, we built tools that now automate and optimize several different protocols on many chains.

Which chains does Metavisor support?

Metavisor is currently available on Ethereum, Polygon, Arbitrum, Optimism and Binance Smart Chain.

Does Metavisor have a token?

We have a token with the MVR ticker, but hasn't launched yet. Follow us for more updates. More details are available on the docs page.

How does Metavisor make money?

We charge a small performance fee for the services we provide. We also have a token that we plan to launch in the future. We strongly believe that results should provide value, not the other way around.

Where does the yield come from?

Metavisor taps into the larger DeFi ecosystem and earns trading fees by providing liquidity in large pools. These are all real returns from other people trading on the integrated protocols.